Sea Ltd (NYSE:SE) – Q4 2020 Earnings Update – Sea is Building an Internet Powerhouse

Forrest Li is building an outstanding business and we remain increasingly bullish on Sea's long-term prospects

If you missed our original deep-dive on Sea back in November 2020, you can find it here: Our Investment Thesis in Sea Ltd (NYSE:SE) – A $1 Trillion Company in the Making

Please note that this article or any of our other articles do not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products and individuals should consult their financial advisor to discuss their specific situation before taking any action.

Chart Summary (For those who prefer visualizations!):

Highlights:

Overall Sea Group:

Total GAAP revenue of $1.6bn in Q4 2020 which represents 101.6% year-over-year growth (Beat wall street estimates of $1.47bn)

Total gross profit of $533.7mm in Q4 2020 which represents 101.5% year-over-year growth

Total Adj. EBITDA of $48.7mm in Q4 2020 vs. negative ($104.9mm) in Q4 2019 (Missed wall street estimates of $90.7mm; we don’t view this as a concern as management is focusing on growing the business and can flip to focus on profitability at any time)

Digital Entertainment (DE i.e. Garena):

Bookings of $1.0bn in Q4 2020, which represents 111.1% year-over-year growth

Management guided bookings for full year 2021 for DE business to be between $4.3bn – $4.5bn (Midpoint represents an increase of 38.1% year-over-year)

GAAP revenue of $693.4mm in Q4 2020, which represents 71.6% year-over-year growth

Adj. EBITDA of $663.5mm in Q4 2020, which represents 149.1% year-over-year growth (~95% EBITDA margins for DE business)

Quarterly active users of 610.6mm in Q4 2020, which represents a 72.1% year-over-year growth

Quarterly paying users grew to 73.1mm in Q4 2020, which represents a 119.5% year-over year growth and represents 12% of total QAUs compared to 9.4% for the Q4 2019 period

According to App Annie, Garena’s Free Fire was the most downloaded mobile game globally

Garena’s Free Fire was the highest gross mobile game in Latin America, Southeast Asia, and India

Garena’s Free Fire related content recorded over 72bn views on YouTube in 2020 and Free Fire esports tournaments hosted during Q4 2020 accumulated over 170mm views

E-Commerce (EC i.e. Shopee):

GAAP revenue of $842.2mm in Q4 2020, which represents 178.3% year-over-year growth

Management guided revenue for full year 2021 for EC business to be between $4.5bn – $4.7bn (Midpoint represents an increase of 112.3% year-over-year)

Gross merchandise value (GMV) was $11.9bn in Q4 2020, which represents 112.5% year-over-year growth

Gross orders totaled 1.0bn in Q4 2020, which represents 134.6% year-over-year growth

Adj. EBITDA was negative ($427.5mm) in Q4 2020 vs. negative ($306.2mm) in Q4 2019

Adj. EBITDA loss per order decreased by 41.4% year-over-year to ($0.41) per order vs ($0.70) per order in Q4 2019

In Southeast Asia and Taiwan, Shopee ranked first in Shopping category apps by average monthly active users, total time spent in app, and downloads for both Q4 2020 and full year 2020

Shopee was the 3rd most downloaded app globally in full year 2020

Digital Financial Services (ShopeePay / SeaMoney):

>$2.9bn in mobile wallet total payment volume in Q4 2020

>$7.8bn in mobile wallet total payment volume in full year 2020

>23.2mm quarterly paying users for mobile wallet services in Q4 2020

Expanded partnership with Google to offer mobile wallet as a payment option for the Google Play Store in Indonesia

Sea Capital

Sea acquired a capital management investment firm in Hong Kong and formed “Sea Capital”, which will focus on partnering with entrepreneurs in early stage businesses to further enhance investment and capital allocation capabilities in support of Sea’s long term growth strategies

We believe this will continue to give Sea further optionality to acquire up and coming businesses and gives them advantages as a primary capital provider in a region that exhibits poor venture capital allocation in the past; This strategy follows Tencent’s playbook and will give Sea a strategic advantage in acquiring these businesses in the future

Sea Limited (NYSE:SE) is currently priced at $250.00 per share (As of 3/2/2021) which represents a ~37% increase since our original deep-dive investment thesis in November 2020 (~3 months). While the short term results are pleasing, we remain focused on the long-term business prospects rather than short term share price performance. This earnings report continues to drive our long term thesis that Sea has the potential to be a $1T internet company in the future.

SeaMoney’s Platform Opportunity Remains Massive and Continues to be Undervalued by Wall Street Analysts

In our November 2020 publication, we wrote the following:

Southeast Asia’s population is severely under banked and Sea’s SeaMoney platform represents an opportunity to become the leading banking/payment provider in the region. Singapore has strict digital banking license requirements and Sea holds the “progression” license (step 2 out of 3) which currently limits the scope of how much individual users can deposit ($75,000 per individual). Sea is currently being reviewed for the digital-full-bank license which would remove this cap. We believe Sea has demonstrated compliance with Singapore banking regulations and it is only a matter of time before they are granted full license privilege. Once granted, this would further enhance product value to customers as it could be the go-to banking product in the region. This additional regulatory hurdle would slow growth to competing financial products and as Sea continues to integrate SeaMoney with Shopee (e-commerce offering) and Garena (gaming), it’s only a matter of time before SeaMoney is the #1 digital banking product in the region

A few weeks after we wrote our original post, Sea was selected for the Digital Full Bank License in Singapore. This complete license allows Sea to offer a full service digital banking service that addresses underserved financial needs and has potential to be deeply integrated with Shopee and Garena.

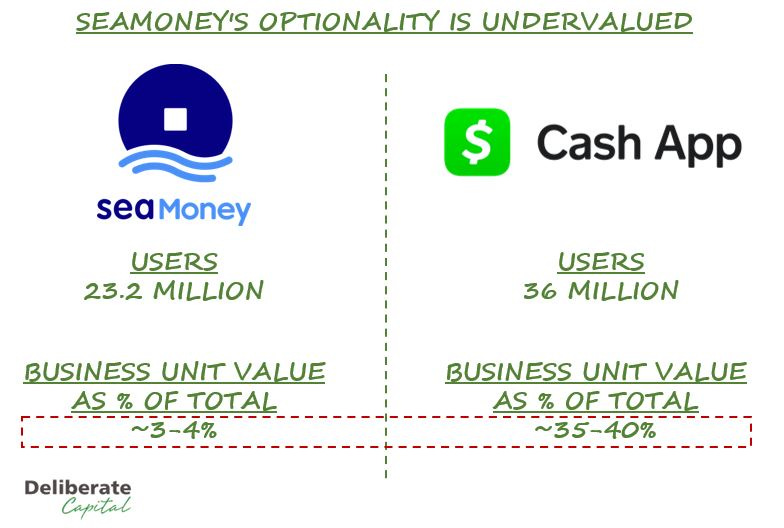

For comparison, Square’s (NYSE:SQ) Cash App ecosystem, which provides an assortment of financial products and services to help individuals manage their money (predominantly in the USA), reported 36mm monthly active users in December 2020 vs. SeaMoney’s 23.2mm quarterly paying users in Q4 2020.

We find it interesting that Wall Street analysts who cover Square are increasingly bullish on Square’s Cash App and its ability to replace traditional banking products but less enthusiastic with regards to SeaMoney.

Wall Street analysts estimate that Square’s Cash App revenue of $10.3bn in 2025E will represent ~35-40% of Square’s total revenue and value Square’s entire business accordingly. In comparison, analyst estimate SeaMoney will represent ~3–4% of Sea’s total business value.

While we understand that SeaMoney will probably never achieve the analyst’s estimates of $248 average revenue per user (ARPU) of Cash App given the lower ARPUs present in Southeast Asia, we believe that Wall Street is severely underestimating this business unit for Sea in the same way they originally underestimated Shopee as an E-commerce platform.

SeaMoney currently has 65% of the total user based of Square’s cash app with less competitive threats (given limits on the number of Singapore digital bank licensees available) and SeaMoney has better integration into Sea’s other product offerings.

Note – We are not saying we view Square’s Cash App/business in a negative way, but simply that Wall Street is underestimating SeaMoney’s value.

Q4 2020 Earnings Call

“..There have been, during the last few months, report about you acquiring a bank in Indonesia. If you can provide more color on that, that will be helpful?”

-Varun Ahuja (Credit Suisse Research Division)

“In terms of the Indonesia bank, we have gotten a bank license in Indonesia as well, and we see this as an integral part of our SeaMoney segment where we continue to build out the infrastructure for digital payments as well as digital financial services. We'll continue to focus on the technology front of our business as part of our core DNA. But at the same time, our focus is to use the technology that we have in our Internet DNA to see how best to further strengthen the digital economy infrastructure in our region, which were products. And at the same time, we believe there are significant opportunities in the long run that could even exceed the size of our current opportunities we're looking at–in that segment. So we're very–we're going to adopt a very long run view towards that and look at digital financial services as a highly comprehensive segment, and each part as integral part of our long-term venture into digital financial services”

- Yanjun Wang, Sea Group Chief Corporate Officer

Optionality Continues to Remain a Driving Force in Sea’s Businesses

Dennis Hong, founder of ShawSpring Partners and an investor we respect immensely, recently wrote about how investors can use a framework for understanding optionality in a business.

We encourage you to read his entire piece as it is a powerful mental model for discovering undervalued businesses.

Our definition of Optionality is derived from that of Real Options, which are defined as “an economically valuable right to make or else abandon some choice that is available to the managers of a company, often concerning business projects or investment opportunities.” These options are “real” because, unlike most financial options, Real Options are typically tangible or intangible assets, like a factory or software, instead of financial instruments.

Similar to Real Options, Optionality is an investment made by a Business, such as a new product launch, expanding to a new geography, or starting a new business unit. The fundamental difference between Real Options and Optionality is that investors operate in an efficient market environment. This means that unlike the Business which can abandon an investment, minority shareholders are beholden to how the market views the value creation or destruction of such investments.

We think that the market aptly prices a Business whose information is properly disclosed to the public―as is typically the case for the core business. Take for example, the growth of a brick-and-mortar retailer expanding in its home geography; while this kind of expansion can result in satisfactory shareholder returns, trading on this information is mostly acting on the explicitly analyzable core business. Therefore, we must incorporate the market’s expectations into our definition; to be considered an “option” there needs to be some mystery to the consideration, or it would likely already be incorporated in the Business’ valuation. This is why Optionality needs to be “unknowable or difficult for the market to discern.”

Although quantified on an absolute basis, the impact of Optionality is relative to the Business’ current size.

The key, then, is to identify situations where Optionality’s expected value is high relative to that of the existing Business.

-Dennis Hong, ShawSpring Partners

Optionality provides investors with an opportunity to take advantage of potential asymmetric upside opportunities that aren’t being captured by the market.

In 2018, the market was skeptical of Shopee’s cash burn and unit economics, and as a result Garena comprised most of Sea’s value. As Shopee’s business fundamentals improved, so did it’s valuation and now the market understands that this is a core value driver.

We believe that Sea still has plenty of optionality left in multiple business units:

Free Fire’s expansion into new geographic regions and higher monetization of engaged user base

Shopee’s expansion in Brazil, LATAM and other regions as well as increased engagement and monetization of its current markets

SeaMoney’s value as digital banking platform

SeaCapital; Sea’s new investment arm formed with their acquisition of Composite Capital Management (Led by David Ma) is aimed at investing in new and growing businesses, likely giving Sea the leading opportunity to acquire the successful ones in the future – We believe Forrest has a knack for hiring amazing talent and it’s great to see Patrick O’Shaughnessy regarding David as “one [of] the best” he has ever met.

While Sea still has risks revolving around widening operating losses and negative FCF, we believe Forrest Li understands the future cash flow generation potential of his business. Forest is using Garnea’s cash flow to supplement Shopee and SeaMoney’s expansion which should drive sustained network effects over the long run.

Disclosure: The Authors are currently long Sea Limited (NYSE:SE).

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products and individuals should consult their financial advisor to discuss their specific situation before taking any action.

Great write up! Enjoyed it!