Our Investment Thesis in Sea Ltd (NYSE:SE) – A $1 Trillion Company in the Making

Missed out on investing in Amazon (AMZN), Square (SQ), and Tencent (TCEHY)? Sea Limited combines the best of all 3 into one investment

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products and individuals should consult their financial advisor to discuss their specific situation before taking any action.

Too Long, Didn’t Read? Quick Highlights:

The gaming industry is growing exponentially as people worldwide increase both hours played and hours watched

Sea’s target market of Southeast Asia is demonstrating exponential growth which is further fueled by cultural norms that respect professional gamers at similar levels to how Americans respect professional athletes

Sea’s management understands and is focused on capturing both the video game players, as well as video game spectators. We believe this is crucial for improving the value that a complete gaming platform offers to its users, driving product stickiness, and increasing monetization in the long term

The E-commerce market opportunity in Southeast Asia is massive at +$80 billion today and is growing at an attractive ~23% compound annual growth rate to +$300 billion by 2025. Empirical evidence from examining the US market structure demonstrates that the #1 player takes most of the value due to network effects and scale (To read more about this phenomena, we recommend reading NFX’s post on how 70% of Value in Tech is Driven by Network Effects). Sea is becoming the market leader as demonstrated by increasing web traffic data, monthly-active-users, and independent 3rd party market share reports. Southeast Asia e-commerce is ~2 years away from solidifying a winner where, at that point in time, new entrants will no longer be able to effectively compete. We believe Sea is positioned favorably to emerge as champion

Southeast Asia’s population is severely under banked and Sea’s Seamoney platform represents an opportunity to become the leading banking/payment provider in the region. Singapore has strict digital banking license requirements and Sea holds the “progression” license (step 2 out of 3) which currently limits the scope of how much individual users can deposit ($75,000 per individual). Sea is currently being reviewed for the digital-full-bank license which would remove this cap. We believe Sea has demonstrated compliance with Singapore banking regulations and it is only a matter of time before they are granted full license privilege. Once granted, this would further enhance product value to customers as it could be the go-to banking product in the region. This additional regulatory hurdle would slow growth to competing financial products and as Sea continues to integrate Seamoney with Shopee (e-commerce offering) and Garena (gaming), it’s only a matter of time before Seamoney is the #1 digital banking product in the region

Sea is led by an extraordinary founder (Forrest Li) who has stayed under the radar as Forrest prefers to avoid the media spotlight. We believe he possesses similar qualities to some of the greatest leaders today (Jeff Bezos, Jeff Lawson, Patrick Collison, John Collison, and Howard Schultz)

Leadership qualities we look for:

Leaders who are obsessed with the customer experience

While most companies pitch that they are focused on the customer, if you attended their quarterly management meetings, you’d be surprised by how many managers instead get caught up in financials, competition, and short term stock price

Leaders who have extreme conviction, and passion, in what they do and it’s no longer about monetary gain

Leaders who understand that cash is king and have become expert allocators of capital to maximize long term cash generation

Company Overview

Sea Limited (NYSE:SE) is a Singapore-based internet business that is the parent company of 3 distinct brands in Southeast Asia 1) Garena; a gaming platform 2) Shopee; an e-commerce app 3) SeaMoney; digital financial services product

Market Dynamics

Sea currently competes in 3 markets:

Digital entertainment (with a focus on mobile/desktop gaming) under their Garena brand

E-commerce under their Shopee brand

Digital Financial Services under SeaMoney brand

Digital Entertainment and the Power of Gaming

The growing digital economy has tremendously benefited the gaming industry in Southeast Asia. Sea began as a gaming company in 2009 and was one of the first to not only identify the compounding power of this trend, but properly capitalize on it.

When most people think of gaming, they think of playing video games on either a PC, console, or smart phone. What many people have a hard time grasping is that future industry growth is also being driven by viewers of games.

In 2018, YouTube gaming and Netflix both released data on how people were consuming entertainment. Netflix reported 51 billion hours of total watch time on their platform and video gaming watch time was in-line with 50 billion hours of total watch time. While both industries have seen benefits under the COVID-19 imposed lockdowns, we believe gaming viewership has surpassed Netflix watch time and will continue to see exponential growth in the future.

In Southeast Asia, the “Big Six” gaming countries consist of Vietnam, Thailand, Philippines, Indonesia, Malaysia, and Singapore. The “Big Six” drive higher gaming adoption as they are all higher growth economies with a rising middle class population who continue to allocate more disposable income to hobbies like gaming. In Southeast Asia, it goes a step further as gaming becomes a cultural norm similar to professional sports in the United States.

To better understand this, we spoke to a colleague who grew up in Indonesia to get his perspective on this cultural difference. He summed it up simply when he said, “In America, many kids dream of becoming professional athletes. While that also holds true in Indonesia, we are generally not genetically built to be large and athletic vs. the rest of the world. You first saw gaming adoption as a mainstream outlet in South Korea in the 90s, [where the country focused on improving their infrastructure to increase internet speed everywhere] which ultimately allowed gaming to grow. While Indonesia still has a long way to go in terms of infrastructure vs. South Korea and other developed nations, the younger generation is growing up with smart phones….and I would say that many of those kids view gaming as a more realistic avenue to become a pro (vs traditional sports) as gaming is not dependent on genetic size and athleticism. The simplest example of this to me is looking at any center or power forward in NBA. While it’s fun to watch them dunk the ball and get rebounds, I think that many people in Indonesia view it as something that came with a lot of luck, as you can’t teach someone to be that tall. Gaming on the other hand, is truly becoming known as a sport in Indonesia that puts everyone on equal footing. So…kids grow up not only playing games, but spending hours watching their favorite streamers in order to get better….that is why I believe we’ll see higher adoption in this region.”

To put the importance of gaming into further context, consider that in 2023 it is projected the number of mobile and PC gamers in Southeast Asia alone will generate revenue in excess of $8.3bn. Additionally, more than 50% of Southeast Asia’s online population reports spending money on games, and we have a high degree of confidence that in the next 5 – 10 years, such spend numbers will increase significantly.

Have you heard of Fortnite, the popular battle Royale game that was most recently valued at ~18 billion?….Garena’s Free Fire has 4x the daily active users and has caught up to Fortnite in Google search queries

Worldwide Google and YouTube search popularity on Google Trends

Remember that when comparing two items on Google Trends, it will show you the relative popularity of the two subsequent search queries.

The simplest way to understand this chart is that Garena is catching up and in some ways even surpassing the most popular game in the world, fortnite. The product is also showing extreme stickiness, and not seeing a similar dropoff to fortnite as lockdowns subside.

This is further confirmed when you realize that Garena’s Free Fire has 4x the amount of Daily-Active-Users (DAU) when they reported 100 million Daily-Active-Users in Q2 of 2020 vs fortnite’s roughly 25 million daily active users in 2020.

While Free Fire is Garena’s most popular game and will continue to expand the Garena brand, it is important to realize that Garena also generates revenue with other games developed in-house and by licensing other popular games (League of Legends, Arena of Valor, Speed Drifters, etc.) as the distributor in the region. This reduces Garena’s “individual-title” / “one hit wonder” risk.

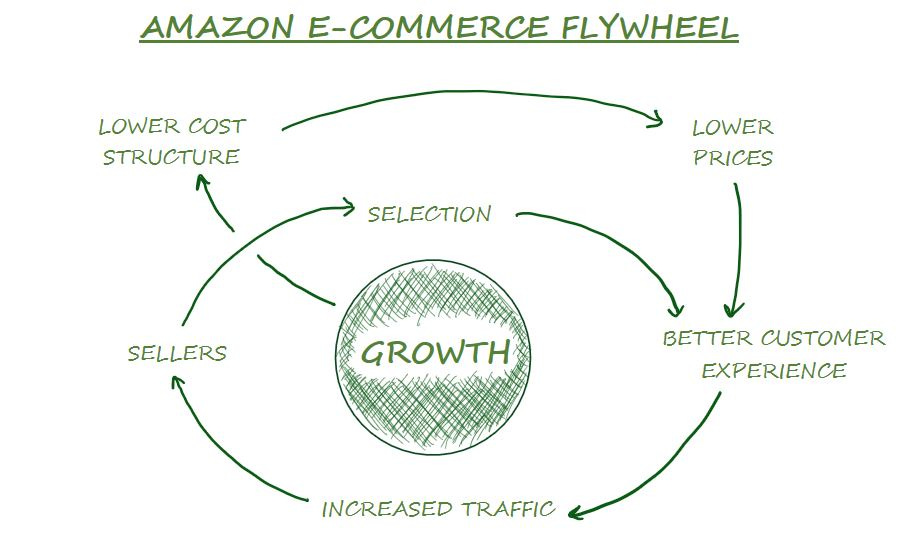

Two-Sided Gaming Platform Flywheel

One thing that differentiates Garena, besides their title catalog is how management holistically approaches the industry. Sea’s management understands that getting people to play games is only one aspect of monetization and that the next big wave will come from viewers. Garena continues to increase marketing spend and focus on viewers with nationally hosted tournaments and live streams. A few tournaments in Southeast Asia have even accumulated 150+ million online views and a subsequent national tournament in Brazil went on to garner more than 47 million views alone.

Garena is unique in that they are building a gaming ecosystem that harnesses the power of game development, game licensing, and widespread viewership through tournament play and streaming. While Free Fire is extremely important for brand establishment and monetization, we believe that establishing a platform via tournaments and live streaming (Garena Live) is critical to properly construct a global gaming brand. Twitch demonstrates the power of establishing a gaming community as more streaming and tournament play results in more views, which in turn naturally expands the community.

We see the potential for Garena to establish a “Twitch-like” community that also possesses the core strength of game development and release schedules. Owning both elements is critical and strengthens Garena’s brand through a two-sided community, where one side is players and the other is viewers.

The network effects associated with this opportunity are tremendous, and would exist from both a playing and viewing perspective; few existing platforms would be able to match this business model leverage. This platform could monetize through traditional game purchasing and in-game spend, but also via advertisements from increases in viewership and streaming. This also forces the top pro gamers to exclusively harness the Garena brand in both playing, streaming, and attending tournaments. Additionally, these are all reasons why Tencent partnered and invested in Sea in 2018.

Martin Lau, president of Tencent said the following about their partnership with Sea, “Garena operates across some of the fastest-growing markets globally and has a deep understanding of the dynamics in these regions. Our long-term partnership and collaborations with Garena on key titles have been successful, and we are glad to further deepen our strategic partnership.”

Note: Tencent owns ~23% of the Sea’s shares outstanding, which we view favorably given:

Tencent is not likely to directly compete against Sea’s given their success generates value to Tencent

Tencent has historically demonstrated the ability to allocate capital efficiently in the gaming ecosystem with investments in other great companies such as Riot Games and Epic Games (Fortnite), which went on to be major hits

Gaming Summary:

The continued acceleration of digital entertainment spend will significantly drive growth as more people spend time online by playing and viewing games

COVID-19 drastically accelerated the online gaming industry, which brought in a surge of new users (up 2x in some markets) at the height of city lockdowns. Even as countries have reopened, platform churn has remained fairly muted, which we believe indicates an underlying consumer preference shift that is here to stay

We believe Sea’s management team is also one of the few companies that understands the power of the two-sided gaming platform flywheel, as they focus on both playing and viewing games. This will ultimately setup the company for future success

E-Commerce and the Shift to Online for the Southeast Asian Consumer

While Southeast Asia is often viewed as an emerging market, they have some of the most active internet users in the world. Compared to North America, where users spend roughly 4 hours online each day, consumers in Southeast Asia spend more than 7 hours online. This region also features countries that rank #1 and #2 in the world as users in Thailand and the Philippines spend more than 9 hours online each day. Despite such usage levels, historically the Southeast Asia region suffered from e-commerce adoption.

We believe this was due to three main challenges:

Limited logistics for sellers

Excessive reliance on cash as a payment method

Lack of both buyer/seller familiarity and trust in platforms

In order to solve these 3 main challenges and bring e-commerce adoption to the region, Sea founder Forrest Li brought on Chris Feng (who had previous experience at other e-commerce companies) to design a new e-commerce company from the ground up. Li and Feng took the successes they saw from other companies and improved upon them by offering additional features to solve these 3 main challenges that were affecting the region.

1 - Problem: Limited logistics for sellers

Solution: Creating logistics partnerships, On-the-ground local teams in each geographic subsector, and offering a new service called “Service by Shopee”

Shopee introduced a simple feature that competitors ignored, which was offering sellers better built-in logistics capabilities (often other platforms made the seller arrange for shipping and delivery themselves). This dramatically reduced the barriers to entry for sellers as these small and medium sized businesses no longer had to worry about product offering and delivery, but could focus specifically on what the end user wanted.

Shopee strengthened this platform advantage for sellers by adding on-the-ground local teams in each geographic locale. While Southeast Asia does have similar cultural values across countries, each individual country has unique challenges that weren’t being addressed by major e-commerce players. By offering on-the-ground teams, Shopee was able to offer faster operational and technological assistance to ensure a satisfactory selling experience. This hyper focused, micro-geographical approach increased seller trust and retention, which ultimately propelled Shopee to the #1 position in the region.

Most recently, Shopee introduced a feature called “Service by Shopee”, which offers a wider range of services to sellers such as inventory management, online store operations, and fulfillment services. Think of this offering as being similar to Fulfilment By Amazon (FBA), which offers additional services to help sellers have more flexibility in how they run their online business.

2 - Problem: Excessive reliance on cash as a payment method & lack of both buyer/seller familiarity and trust in platforms

Solution: “Shopee Guarantee” and better dispute resolution

Historically, buyer adoption of e-commerce shopping lacked traction due to a mistrust between the buyer and the seller. This is the classic “Chicken-and-the-egg” problem where lack of trust makes marketplace adoption poor on both sides. As a buyer, you were not confident you would receive the goods you bought online, as shady practices and scams were abundant. This resulted in buyers skipping upfront online payments and opting to pay with cash on delivery. One can imagine how this would be a problem for sellers, as many were not willing to ship goods without assurance that they would receive payment. Sellers had low confidence that a 3rd party logistics service would bring back their full cash payment from the customer.

Since Shopee had control over logistics, they solved this “Chicken-and-the-egg” problem by introducing what they called “Shopee Guarantee.” Essentially Shopee holds payments made by buyers in designated escrow accounts until the ordered products are received and reviewed by the buyer. Shopee would then release the payment to the seller (This becomes an additional growth lever as Shopee strongly encourages customers to leave reviews helping other buyers gain a better shopping experience). If purchased products are never delivered to the buyer, or the buyer is not satisfied, Shopee will return the funds to the buyer after internal investigation.

This cultivates user trust for both the buyer and the seller as settlement risk is dramatically reduced. While buyers still have the option to pay with cash, this product offering increases the adoption of yet another Sea product which is electronic payments (SeaMoney).

Other built in functionality to increase buyer/seller trust include a dispute resolution tool where on-the-ground teams help resolve disputes between buyers and sellers, and a communication platform that offers a live chat function enabling real-time communication between the buyer and seller.

Core Gaming Ideology Drives Further E-commerce Adoption

As part of management’s strategy to increase user engagement on the Shopee platform, they introduced innovative social and gamification features such as “Shopee Coins,” “Shopee Live,” “Shopee Games” and “Shopee Feed.”

Users can win Shopee Coins from making purchases, playing mini-games and participating in campaign activities and live video chats (Shopee Live). Users are then able to use these Shopee Coins to offset the cost of their purchase from eligible sellers. Users may also earn additional Shopee Coins by inviting their friends to participate, which further encourages social activity on the platform

Shopee Live allows buyers to watch livestreaming by sellers from their mobile phones in which sellers may promote their goods or conduct real-time engagement with buyers for potential sales and brand-building

Shopee Games are a variety of mini games that promote in-app interactions between fellow users through achieving individual or group rewards. This feature increases user engagement, platform interaction, and promotes positive user experiences

Shopee Feed allows users to continuously scroll through a lively ecosystem of multimedia listings where they can “like” or “comment” as they discover popular items based on platform trends, new inventory from “followed” sellers, and their previous browsing categories

This core gamification feature give Shopee an interesting flywheel that strengthens the platform for both buyers and sellers.

Southeast Asia E-commerce Market Size and Growth is Mind Blowing

The retail e-commerce market in Southeast Asia was $80 billion in 2019 and it is expected to reach +$283 billion by 2025 (This represents a 23% compound annual growth rate in market size alone). In 2019, Shopee generated $823mm in e-commerce revenue and based on Q1 2020 and Q2 2020 results, Shopee is on track to do $1.8bn for the full year 2020.

Lasting E-commerce Adoption from COVID-19 is Expected Across all of Southeast Asia

COVID-19 has pushed forward e-commerce adoption in the region and even after the pandemic subsides, this trend will most likely not revert to pre-pandemic levels.

Shopee is Emerging as the #1 Player

In analyzing monthly web traffic data and consumer surveys, it has become clear that Shopee’s e-commerce gamification flywheel is working, as they emerged as the #1 e-commerce company in Southeast Asian during Q3 2019. These trends accelerated sharply into the pandemic as competitors lost web traffic, indicating that Shopee is generating most of the value.

In the United States, Amazon received ~49% of total e-commerce spend in 2018. (In reality, this number is probably much higher, as Amazon continues to play down this statistic to avoid regulation). If you look at Amazon’s top 3 competitors, eBay represented 6.6%, Apple 3.9%, and Walmart 3.7%.

It is apparent that the #1 player in the e-commerce market receives most of the value. We believe this is true as economies of scale and network effects allow the incumbent to provide increased value for both buyers and sellers on the platform. Most people today start their product search on Amazon.com directly vs. using a search engine or a competing website. This effect drives a similar growth loop to what we described above as more sellers on the platform increase the number of products available, and enhance the value proposition for buyers to use Amazon over other options.

Based on this comparable analysis with the United States market, we believe a similar phenomenon will play out in Southeast Asia. The growth loop is reaching critical mass as demonstrated by the #2 player Lazada losing substantial web traffic and market share.

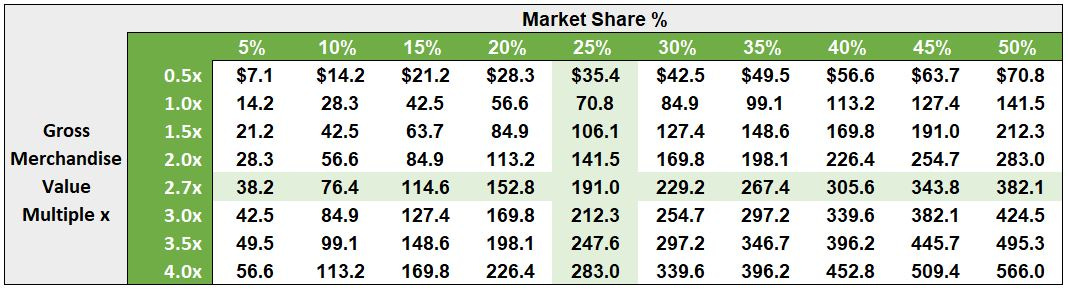

2025 Southeast Asia E-commerce Market Penetration & Valuation

While Sea is more than just an e-commerce marketplace, we believe Sea is significantly undervalued based on the Shopee business segment alone.

While analyzing other marketplace businesses (Etsy, Ebay, Farfetch, etc.) that report Gross Merchandise Value (GMV), it is observed that they trade in the 0.5x - 5.2x range with an average GMV multiple of 2.7x.

While it’s impossible to know the exact market share % that Shopee will achieve, as well as the GMV multiple the future business will trade at, we believe Sea has substantial upside with potential market share capture of +25% (which is roughly half of what Amazon has).

Implied 2025 Shopee Valuation ($ in Billions) - Shopee’s Business Alone Could Propel Sea to +2.2x Return

Note: 11/20/2020 Sea Limited Fully Diluted Total Enterprise Value is ~$97 billion per Capiq

SeaMoney is Becoming the Digital Financial Services Go-to Product in Southeast Asia

Consumers and SMEs have adopted digital financial services at a rapid clip and we believe that such behavioral changes are structural and will accelerate adoption and penetration. The pandemic has led consumers to establish newfound online habits as they have shifted away from cash and increased trust in transacting online. Kantar research shows that the average number of cash transactions per consumer has declined from 48% pre-COVID-19 to 37%. During this same period, e-Wallet transactions rose from an average of 18% pre-COVID-19 to 25% post-COVID-19, indicating that a fundamental shift in consumer behavior is underway.

Merchants have rushed to accept digital payments, with large acquiring companies and traditional financial institutions supporting merchants by teaching them how to use online payments. Bain has estimated that due to COVID-19, continued digital financial services adoption will create lasting payment habits, leading to $1.2 Trillion in Gross Transaction Value (GTV) by 2025. SeaMoney has capitalized on such trends and is in prime position to continually monetize on increased digital transformation. Q3 2020 paying users of the mobile wallet surpassed 17.8 million, while total payment volume surpassed $2.1billion (representing a 31% increase QoQ).

Equally impressive is the fact that >30% of Shopee’s Gross Orders were paid using Seamoney wallet in October. This is evidence that Sea is in the midst of building a virtuous cycle between Shopee and SeaMoney. Increased total payment volume is directly resulting in further eCommerce penetration creating an empowerment loop that has potential to create supercritical network effects. Additionally, Indonesia is Shopee’s largest market which is quite encouraging, as the median age in Indonesia is ~30 years old with ~42% of the population in the 25 – 54 age range. This excites us, as we believe continued digital wallet acceptance will be prevalent with this group.

Indonesia’s population remains fairly underbanked as J.P. Morgan estimates that at least 48% of consumers are under or not banked at all. This is mainly due to lack of trust in the banking system, resulting in lower online purchasing, as cash is the default transaction method. We expect that user migration to online services and e-commerce in Indonesia will spark a digital payment transformation, similar to what was observed in China (via Tencent and WePay) where digital payments became the default method. Increasing digital payment adoption over time is a key component to our long term investment thesis, as SeaMoney could potentially be worth billions of dollars on a standalone basis over the next several years.

Singapore’s Strict Regulation on Digital Banking Would Provide Regulatory Barrier-to-Entry for Competing Financial Products

Article Update: On 12/4/2020 Sea obtained the full banking license from Singapore’s central bank, read more about it here and here

Singapore has strict digital banking license requirements and Sea holds the “progression” license (step 2 out of 3) which currently limits the scope of how much individual users can deposit ($75,000 per individual). Sea is in the process of being reviewed for the digital-full-bank license which would remove this cap. While there is risk that Sea will not be granted the full license, Sea’s management has consistently demonstrated compliance with Singapore banking regulations. This improves goodwill with the authorities given the growing importance of Seamoney to consumers and decreasing financial risk as Sea’s businesses scale. In our view, it is not a question of if, but a question of when they will be granted full license privilege.

Once obtained, this would enhance product value to customers, as it could be the preferred banking product in the region, allowing Sea to expand via other verticals of digital financial services. Additionally, this regulatory hurdle slows growth to competing financial products, and as Sea continues to integrate Seamoney with Shopee (e-commerce offering) and Garena (gaming), Seamoney could become the #1 digital banking product in the region.

Sea is Led by a World Class Visionary that is Superbly Managing at Scale

Sea is led by Forrest Li who has prior experience at Viacom, Corning, and Motorola. He holds an MBA from Stanford Business School and a bachelor’s degree in Engineering from Shanghai Jiaotong University. Li founded the business in 2009, and currently serves as CEO and Chairman. We heavily favor investing in founder led businesses when a founder has proven that he or she can effectively manage an ever changing and growing organization.

Forrest Li was at Stanford when Steve Jobs gave his famous 2005 Commencement Speech where Jobs offered his famous line, “stay hungry, stay foolish.”

Li later said that speech by Jobs changed his life. “I think that plays a very important role in why I decided to jump out of the corporate world and to turn myself into an entrepreneur. I remember during those days, I re-watched the speech, probably like two, three times a day for months.”

Li continues to embrace this motto in everything he does. His peers describe him as someone who is obsessed with product and user experience. We heavily favor managers with serious interest in creating products that promote market leading user experience. It can be observed that in the long run, internet and marketplace managers drive outperformance through creating high levels of user engagement and satisfaction (Amazon, Facebook, AliBaba, Tencent, etc). It is our belief that Li is focused on creating a wide competitive moat through brand and network effects, which overtime will be predicated on positive and sustained user experience.

Valuation

Traditional valuation metrics, coupled with a rearview mirror perspective, position Sea outside of what we would consider “cheap”. Metrics such as Enterprise Value (EV) EV/EBITDA, EV/EBIT, and P/E are not relevant, given the early stage and rapid growth profile of the business. We prefer to consider EV/Revenue when analyzing this opportunity, and when looking 2-5 years out conclude valuation is rather palatable.

For illustrative purposes, let us look at the current TEV/LTM Revenue ratio of ~22x. In isolation this may seem expensive, especially when considering the general universe of internet and e-commerce comparables. But if we decide to properly digest the growth potential of Sea, and evaluate the opportunity on a forward basis, the story changes dramatically. Wall Street consensus estimates peg TEV/2021E revenue around ~12x, nearly a 10x compression from current levels. Additionally, when looking at the TEV/2021E revenue ratio for public internet marketplace comparables we see they currently trade for ~7x. This conveys that in one year, Sea will trade ~4x – 5x higher than comparables, but on a conservative basis have a ~20 – 30% greater 2021E revenue growth profile. When evaluating Sea with this lens, we gain additional comfort with valuation.

Furthermore, due to Sea’s robust growth profile, we feel the more telling metric to look at is Growth Adj. TEV / Rev, which implies Sea trades at a discount to our public comparable universe. For those unfamiliar with this metric, it helps us properly evaluate opportunities where we feel growth, rapid market penetration, and overall market expansion are key value drivers.

Note:

Growth Adj. TEV / REV is calculated by taking the projected revenue multiple for a given year and dividing it by the corresponding growth rate. For example, one would take 11.8x (Sea 2021 TEV / REV) and divide it by 49% (Sea 2021 revenue growth rate) to generate an adjusted multiple of 0.24x.

The below figures, including Sea, are based on Wall Street Consensus estimates. We have generated our own financial forecast independent of consensus, and have a high degree of confidence that management can outperform the consensus estimates, but for the purpose of this memorandum, we have chosen to use the high level table below.

Risks

Lack of Profitability – Sea is currently not profitable and may not be for the foreseeable future. Although this is assuredly a risk worthy of consideration, we tend to not be overly concerned. The company is rapidly eating market share via robust platform growth and superb product experience. This strategy of expanding while providing customers with a sticky and memorable experience, is anything but cheap, especially with Shopee and e-commerce. We are excited that in ~5 years of launch, Shopee has become the largest e-commerce platform in ASEAN and still has an ocean of opportunity in the next decade.

Furthermore, we are ecstatic the Company is properly spending to solidify the #1 position as the default ASEAN e-commerce platform. While such OpEx serves as a drag on FCF generation and profitability, we believe in the long term operational leverage of the business and would much rather have management scale to capture market share through properly allocated spend, than worry about short term profitability. There are two important items to consider when evaluating future profitability:

Sea can afford to aggressively scale as an e-commerce platform, since this growth is in part subsidized by the highly profitable Garena gaming segment

Scale will ultimately result in improved take rates and operational efficiency. This is economies of scale and pricing power at play and every uptick in take rate will be accretive on a profitability basis

Reliance on the Gaming Business – Sea’s dependence on gaming has historically been substantial and such reliance can seem off-putting. Sea’s digital entertainment business generated 88.2%, 55.9%, and 52.2% of total revenue in 2017, 2018, and 2019 respectively. Additionally, the profitable nature of the digital entertainment business has been the driving force of gross profit thus far. We believe this is a worthy risk to consider, but also are aware of the following considerations:

In 3 years, the dependence on gaming has dropped significantly, indicating that the complete business architecture is working quickly and effectively. Sea is still in the stages of incipiency, and it would be unfair and foolish for us to dismiss the notion that aggregate profitability will take time

The gaming business subsidizes platform construction and lets Li properly build out the e-commerce and digital payment engines. We are choosing to invest in what we believe will become a powerful platform, with potential in gaming, e-commerce, and financial services. However, we accept the risk that the gaming vertical possesses the most horsepower early on and the other verticals are still nascent

We will continually monitor the gaming business and will consider Sea’s ability to develop and license popular games in the future. While Free Fire has been extremely successful, we would like to see replication of such success in the coming years through the release of additional powerhouse titles

Regulatory Risk – Sea could fail to get access to the full digital banking license in Singapore which would limit the financial products available to consumers and inhibit growth.

Control Risk – Given Sea’s geographic presence across many countries, the organizational structure is complex, with the holding company based in Singapore. Specific country legal laws in certain jurisdictions such as Thailand and Vietnam have rules on foreign ownership. As such, Sea has created a complex structure with variable interest entities.

The gaming and financial service business in Vietnam is conducted through VIE structure, which involves a series of contractual agreements with Vietnamese citizens that ultimately allow Sea to control the entities.

Note: This is commonly used among Chinese companies listed in US with Alibaba being the most prominent example. While we aren’t majorly concerned with this issue given other precedents, it is a potential risk that should be properly considered.

Disclosure: The Authors are currently long Sea Limited (NYSE:SE).

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products and individuals should consult their financial advisor to discuss their specific situation before taking any action.

Share price as of publishing date (11/20/2020 closing price): $183.11

Did you like this post? Please leave a comment, subscribe, and share!

Hi there, thank you so much for this great write-up. I might be very late to the party but I've just one question. When calculating the Growth Adj. TEV / REV, aren't we technically "double-counting" the company's growth by dividing it by its underlying growth rate? I might have understood the rationale behind dividing the multiple by the corresponding growth rate.

P.s. I've read your post on Elastic NV and I really enjoyed it. Hope you guys continue posting the splendid work!

Hi there, thank you so much for this great write-up. I might be very late to the party but I've just one question. When calculating the Growth Adj. TEV / REV, aren't we technically "double-counting" the company's growth by dividing it by its underlying growth rate? I might have understood the rationale behind dividing the multiple by the corresponding growth rate.

P.s. I've read your post on Elastic NV and I really enjoyed it. Hope you guys continue posting the splendid work!